Bitcoin Price Levels to Watch as Cryptocurrency Retreats After a Strong Month

- Bitcoin (BTC) slips Monday after a strong September, but key price levels suggest potential gains.

- Watch for resistance at $68,500, $72,000, and $97,000, while keeping an eye on $60,600 as support.

- Bitcoin recently reclaimed its 200-day moving average, signaling possible bullish momentum.

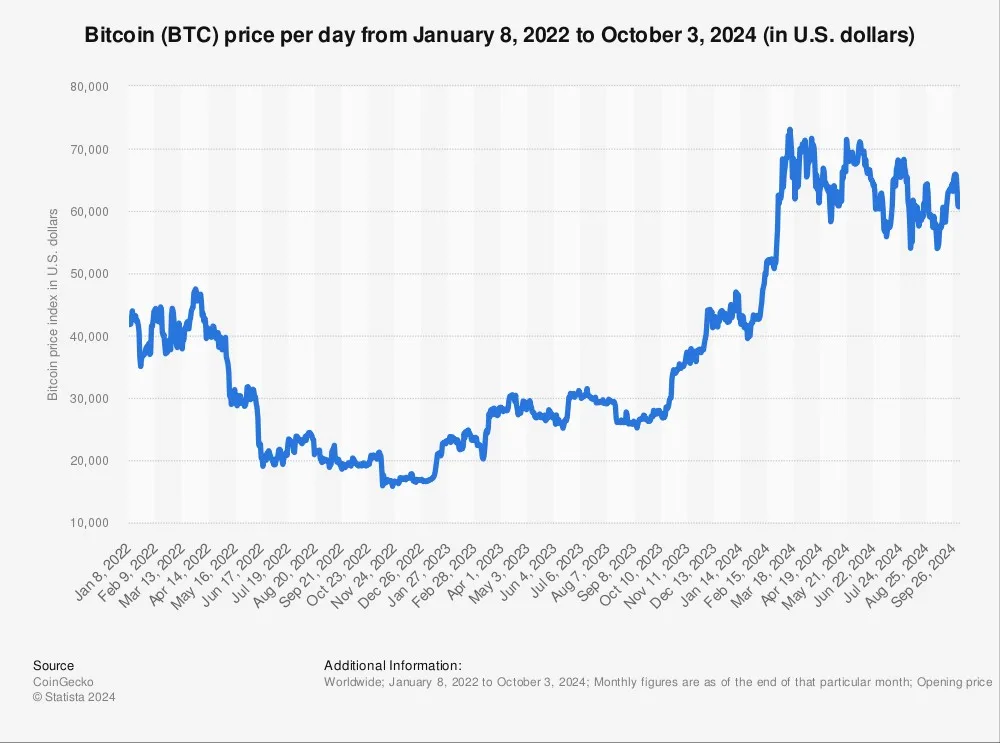

Bitcoin (BTC) started the week lower, giving up some of the gains from a strong rally in recent weeks. Despite Monday’s decline, Bitcoin remains up about 8% in September, a month that typically sees weaker performance.

Recent price gains have been partly fueled by the Federal Reserve’s interest rate cut and economic stimulus measures from China. Investors should keep a close watch on several key technical levels as Bitcoin approaches crucial points on its chart.

Are you looking for the best trading platform? Sign-up to the best trading platform for you for FREE. Takes 2 mins.

Bitcoin’s Descending Channel Breakout in Focus

Since reaching an all-time high in March, Bitcoin has been moving within a multi-month descending channel. However, after bottoming out at the channel’s lower trendline earlier this month, BTC has staged a strong rally to the channel’s upper boundary and reclaimed the 200-day moving average (MA), a key technical indicator.

The potential for a breakout above the descending channel means investors should pay attention to several overhead resistance levels while also keeping an eye on key support areas during any retracements.

Key Price Levels to Watch

- $68,500: This level marks a resistance area just above the channel’s upper trendline and could pose a challenge as it aligns with twin peaks formed in July.

- $72,000: A move above $68,500 could push Bitcoin towards $72,000, where investors may lock in profits near peaks just below Bitcoin’s all-time high (ATH).

- $97,000: Using technical projection techniques, such as a bars pattern, the upside target for a breakout could extend to $97,000, based on previous price action following similar pullbacks.

Important Support Level to Monitor

If Bitcoin experiences a retracement from the channel’s upper boundary, the $60,600 level becomes critical. This area provides a confluence of support from the 50-day moving average and a trendline that connects several key trading levels from February to September.

S&P 500 Hits Record High; Dow Gains as Longboard Pharmaceuticals Surges 51% and Tech Stocks Rise S&P 500 Reaches Record

S&P 500, Dow Notch Record Closing Highs as Crude Slumps Major Indexes Set Record Highs: The S&P 500 and Dow

Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future Plug

MicroStrategy Stock Rises 550% in 2024: Should You Invest? MicroStrategy (NASDAQ: MSTR) has been one of the top-performing stocks in

One of Tesla’s Biggest Bulls ‘Disappointed’ After Robotaxi Event Tesla’s much-anticipated Robotaxi event left one of its most ardent supporters