Solana Faces Bear Market as Competition Heats Up and Death Cross Looms

- Solana’s price has entered a bear market, dropping over 34% from its yearly high.

- The network faces stiff competition from Tron, Arbitrum, and Sui.

- A death cross chart pattern may soon form, signaling more downside risk.

The Solana (SOL) price remains trapped in a deep bear market as the crypto sector continues to consolidate. Trading around $140, Solana is now down by over 34% from its year-to-date high, giving the blockchain a market cap of approximately $64 billion.

Are you looking for the best trading platform? Sign-up to the best trading platform for you for FREE. Takes 2 mins.

Rising Competition for Solana

Solana’s pullback aligns with the broader downturn in the cryptocurrency market and a growing sense of fear among traders. Data from CoinMarketCap shows the Crypto Fear and Greed Index has fallen to 38, reflecting weak market sentiment.

Solana is also reacting to rising competition from rival blockchain platforms. One of its biggest competitors is Tron, a blockchain project founded by Justin Sun, which recently launched a meme coin generator.

While it’s still early, Tron is gaining traction. Tron’s SunPump ecosystem has seen hundreds of new meme coins emerge, including SunDog, Tron Bull, and Invest Zone, which together have accumulated close to $600 million in assets in a short period. SunDog leads the pack with the highest market cap.

On the other hand, Solana’s Pump.fun ecosystem also boasts hundreds of meme coins, with a combined market cap of over $552 million. Popular tokens include Fwog, Michi, Mother Iggy, and Daddy Tate.

Meanwhile, Tron’s SunPump has generated over $51 million in fees, an impressive number for such a new platform.

Solana faces further competition from layer-1 and layer-2 networks like Coinbase’s Base, Sui, and Arbitrum. Solana’s decentralized exchange (DEX) transactions reached $4.8 billion over the last seven days, while Base hit $3 billion, despite being only a year old.

Fading Solana ETF Hopes

Another factor behind Solana’s price drop is waning optimism for a Solana ETF. After the SEC approved spot Ethereum ETFs, there was speculation that Solana might follow suit.

However, recent data suggests that institutional interest in a Solana ETF is low. Research by SosoValue shows that while Ethereum ETFs hold $6.6 billion in assets, they’ve experienced $581 million in outflows, suggesting weak demand from investors.

It seems unlikely that top institutional investors will flock to Solana ETFs, largely because staking yields on Solana offer better returns. That said, Solana’s staking yield has been on the decline, dropping from 7.17% in May to 6.8% currently, though it still offers a decent return.

Solana has also been pressured by liquidations from the FTX Estate, which continues to unstake millions of dollars’ worth of tokens. With $954 million worth of staked tokens still under FTX’s control, further unstaking could lead to additional supply and downward price pressure.

Solana Price Technical Analysis

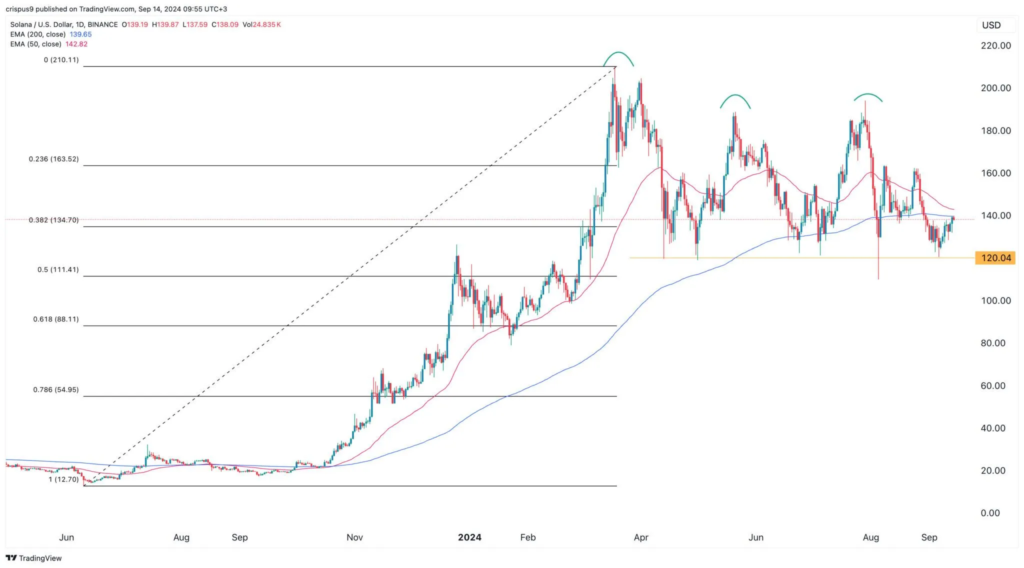

Looking at the daily chart, Solana’s price peaked at $210 in March as the crypto bull market surged, driven by interest in meme coins on its network. Since then, Solana has followed a pattern of lower highs and lower lows, with the bears firmly in control.

The price action has formed a triple top pattern, a well-known bearish signal. Support at $120 has held firm on multiple occasions, including April 12, April 30, June 23, and July 5. A brief false breakout below this level occurred in August, but the price quickly rebounded. This support level aligns closely with the 50% Fibonacci Retracement level.

However, the biggest technical risk for Solana is the potential formation of a death cross—a bearish signal that occurs when the 50-day moving average crosses below the 200-day moving average. For example, Ethereum dropped over 30% after forming a death cross a few weeks ago. Conversely, Solana rallied by over 800% after forming a golden cross in October 2023.

For now, the outlook for Solana remains neutral. If the death cross forms and Solana breaks below the key $120 support, the next target would be the 61.8% Fibonacci Retracement at $88.

On the upside, a move above the 50-day moving average at $145, supported by strong volume, could push Solana to the 23.6% Fibonacci Retracement at $165.

S&P 500 Hits Record High; Dow Gains as Longboard Pharmaceuticals Surges 51% and Tech Stocks Rise S&P 500 Reaches Record

S&P 500, Dow Notch Record Closing Highs as Crude Slumps Major Indexes Set Record Highs: The S&P 500 and Dow

Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future Plug

MicroStrategy Stock Rises 550% in 2024: Should You Invest? MicroStrategy (NASDAQ: MSTR) has been one of the top-performing stocks in

One of Tesla’s Biggest Bulls ‘Disappointed’ After Robotaxi Event Tesla’s much-anticipated Robotaxi event left one of its most ardent supporters