Forex Forecasts: South African Rand (ZAR) and Turkish Lira (TRY)

- South African rand rises ahead of the SARB interest rate decision.

- The Turkish Central Bank is likely to keep rates unchanged.

- The Federal Reserve is expected to cut rates on Wednesday.

This week will be a significant one in the forex market as central banks, including the Federal Reserve and others like Japan’s, release their interest rate decisions. Among the currencies in focus are the South African rand (ZAR) and the Turkish lira (TRY).

Are you looking for the best trading platform? Sign-up to the best trading platform for you for FREE. Takes 2 mins.

South African Rand Outlook

The South African rand has been one of the top-performing currencies in emerging markets. It has rallied nearly 9% from its low this year and is now near its highest level since July 2023.

The USD/ZAR pair has dropped recently following the outcome of South Africa’s election, where the ANC lost its dominance for the first time since apartheid, leading to a coalition with the Democratic Alliance (DA).

As a result, business confidence has improved, and both local and international investors have shown renewed interest in South African stocks. Additionally, there are signs that the country is addressing its power crisis. While load-shedding continues, the frequency has decreased in recent months. South Africa’s credit rating has also improved, with upgrades from Moody’s and S&P Global.

This week, all eyes are on the Reserve Bank of South Africa (SARB) as it announces its interest rate decision. Analysts expect the SARB to begin cutting rates for the first time since 2020, as inflation appears to be under control. The Consumer Price Index (CPI) is forecast to drop to 4.5% in August, hitting the midpoint of the SARB’s target range.

USD/ZAR Technical Analysis

The USD/ZAR pair has been in a steady decline. This trend could continue as the Federal Reserve begins cutting rates, potentially pushing more investors toward emerging markets like South Africa.

The pair has dropped to 17.7, breaking below a key support level at 17.86 from June. It remains under both the 50-day and 200-day EMAs. A bearish pennant pattern has formed, signaling more potential downside, with the next target being the 17.4 support level from July 2023.

Turkish Lira Forecast

The Turkish lira will be closely watched this week as the Central Bank of the Republic of Turkey (CBRT) makes its rate decision. Like previous meetings, the CBRT is expected to leave rates unchanged at 50%, maintaining its stance for the sixth consecutive meeting.

Turkey’s central bank faces pressure due to the currency’s depreciation and high inflation. The Turkish lira has depreciated by over 15% this year and by 26% over the last 12 months, losing 500% of its value over the past five years.

However, there is some good news for Turkey. The CPI has fallen from 72% to 52%, and the CBRT projects inflation will end the year around 40%. Additionally, credit rating agencies like Fitch and Moody’s have upgraded Turkey’s ratings due to improvements in fiscal policy. The country’s fiscal and wage reforms have been well received.

Despite these positives, the outlook for the USD/TRY pair remains uncertain, as President Erdogan has the power to make swift changes to central bank leadership, which adds volatility to Turkey’s economic outlook.

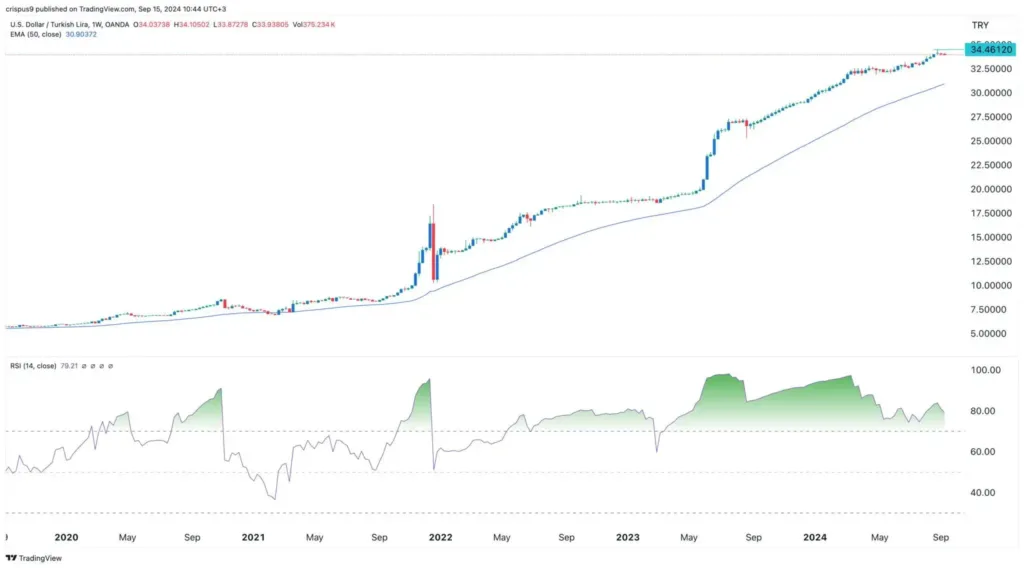

USD/TRY Technical Analysis

The USD/TRY pair has been in a strong bullish trend for some time. It reached a peak of 34.46, up from last year’s low of 18.

The pair has stayed above key moving averages, signaling that the bulls remain in control. The outlook for the USD/TRY pair is likely to stay bullish unless there’s a significant shift in investor sentiment or central bank policy, although a lira rebound cannot be ruled out as foreign investment flows into Turkey.

S&P 500 Hits Record High; Dow Gains as Longboard Pharmaceuticals Surges 51% and Tech Stocks Rise S&P 500 Reaches Record

S&P 500, Dow Notch Record Closing Highs as Crude Slumps Major Indexes Set Record Highs: The S&P 500 and Dow

Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future Plug

MicroStrategy Stock Rises 550% in 2024: Should You Invest? MicroStrategy (NASDAQ: MSTR) has been one of the top-performing stocks in

One of Tesla’s Biggest Bulls ‘Disappointed’ After Robotaxi Event Tesla’s much-anticipated Robotaxi event left one of its most ardent supporters