US Futures Slip After S&P 500 Record High; SAP Shares Drop: Markets Wrap

- US stock futures dipped after the S&P 500 reached its 41st record close in 2021.

- SAP SE shares plummeted after reports of a US investigation into overcharging government agencies.

- Investors focus on central bank policies and upcoming economic data.

US stock futures moved lower following the S&P 500’s latest record close. Contracts on the S&P 500 dropped by 0.3%, while Europe’s Stoxx 600 also saw a slight decline. Shares of SAP SE, the German software giant, fell after news broke that US officials are investigating the company for allegedly conspiring with others to overcharge government agencies over the past decade.

Are you looking for the best trading platform? Sign-up to the best trading platform for you for FREE. Takes 2 mins.

Market Sentiment and Central Banks

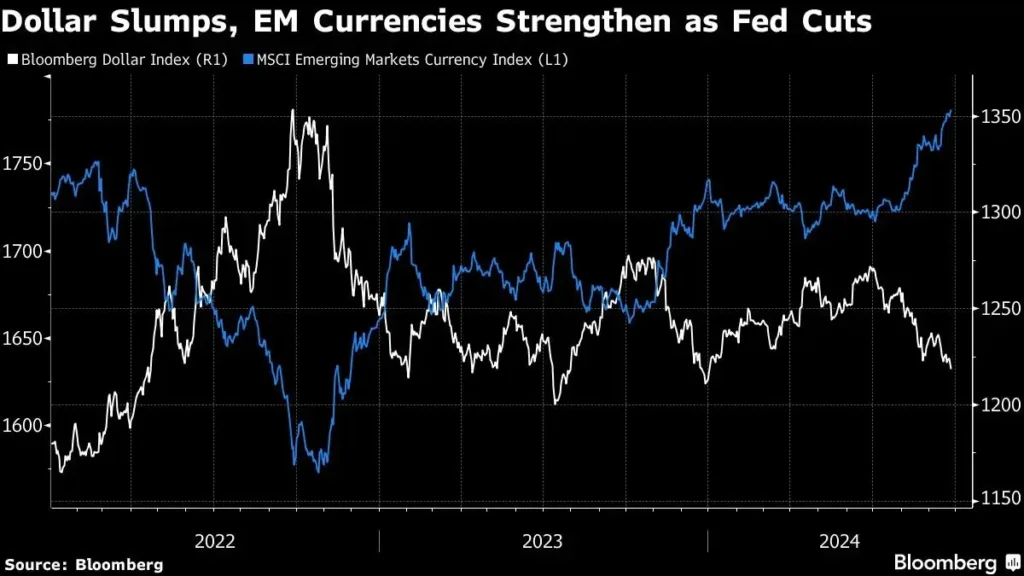

Investors are searching for new market catalysts after last week’s Federal Reserve half-point interest rate cut, which initially boosted risk appetite. However, China’s latest economic measures—announced on Wednesday—had limited effect outside Asian markets, as traders question whether the steps will sufficiently support China’s slowing economy.

In Europe, central bank decisions are under scrutiny. Sweden’s Riksbank cut borrowing costs and signaled the possibility of further reductions. Meanwhile, traders are betting on a rate cut by the European Central Bank (ECB) in October after comments from ECB Governing Council member Klaas Knot, who expects gradual easing “in the near future.” A policy decision is also expected from Czechia this week.

Nvidia Lifts Markets, Consumer Sentiment Slumps

US equities reached new highs on Tuesday, largely thanks to gains in Nvidia Corp.. However, a report from the Conference Board showed the biggest decline in consumer sentiment since August 2021, casting a shadow over the market. The report highlighted concerns about a possible slowdown in the labor market and weaker-than-expected manufacturing data.

“The decline in perceptions of job availability was significant,” noted Carl Weinberg, chief economist at High Frequency Economics, warning that the report sends a troubling signal about the overall economic outlook.

Following the report, swaps traders increased bets on further policy easing from the Federal Reserve, now anticipating at least one more rate cut by the year’s end. Investors are awaiting comments from Fed Chair Jerome Powell on Thursday, along with data on the Fed’s preferred inflation metric on Friday, for clues on the extent of future rate reductions.

China’s Economic Moves

China’s central bank took action on Wednesday by cutting the one-year policy loan interest rate, marking the largest reduction on record. This followed a broader stimulus package introduced earlier. Despite these moves, Chinese stocks remain at a five-year low, as the country continues to struggle with deflationary pressure, weak consumption, and a prolonged property sector slump.

A Bloomberg commodity index climbed for the 11th consecutive day, heading for its longest winning streak since January 2018. Iron ore prices surged, and gold hit another record.

Key Events to Watch This Week

- ECB President Christine Lagarde speaks on Thursday.

- US jobless claims, durable goods orders, and revised GDP data are due Thursday.

- Fed Chair Jerome Powell gives remarks at the US Treasury Market Conference on Thursday.

- China industrial profits and Eurozone consumer confidence data will be released on Friday.

- US PCE inflation data and the University of Michigan consumer sentiment index are also due Friday.

Key Market Moves:

- Stoxx Europe 600 fell by 0.2% as of 8:51 a.m. in London.

- S&P 500 futures dropped 0.2%.

- Nasdaq 100 futures fell 0.3%.

- Dow Jones Industrial Average futures declined by 0.2%.

- MSCI Asia Pacific Index remained unchanged.

- MSCI Emerging Markets Index rose 0.3%.

Currency Moves:

- Bloomberg Dollar Spot Index was flat.

- Euro stayed stable at $1.1189.

- Japanese yen slipped 0.4% to 143.86 per dollar.

- Offshore yuan dropped 0.2% to 7.0224 per dollar.

- British pound declined 0.2% to $1.3386.

Cryptocurrency Moves:

- Bitcoin fell 0.7% to $63,800.

- Ether declined 1.1% to $2,622.75.

Bond Market:

- The yield on 10-year US Treasuries was unchanged at 3.74%.

- Germany’s 10-year yield held steady at 2.15%.

- UK 10-year yield remained at 3.93%.

Commodity Moves:

- Brent crude fell 0.5% to $74.79 per barrel.

- Spot gold remained flat.

S&P 500 Hits Record High; Dow Gains as Longboard Pharmaceuticals Surges 51% and Tech Stocks Rise S&P 500 Reaches Record

S&P 500, Dow Notch Record Closing Highs as Crude Slumps Major Indexes Set Record Highs: The S&P 500 and Dow

Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future Plug

MicroStrategy Stock Rises 550% in 2024: Should You Invest? MicroStrategy (NASDAQ: MSTR) has been one of the top-performing stocks in

One of Tesla’s Biggest Bulls ‘Disappointed’ After Robotaxi Event Tesla’s much-anticipated Robotaxi event left one of its most ardent supporters