Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future

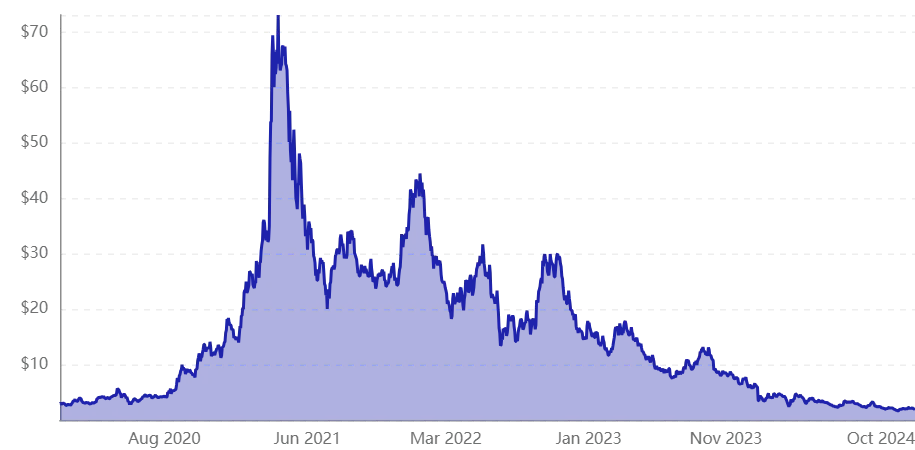

- Plug Power’s stock has collapsed over the past 25 years, losing about 99% of its value since its IPO in 1999.

- The company has struggled with the slow adoption of hydrogen charging solutions, but insiders and institutional investors have been accumulating shares recently.

- Plug Power is trading at $2 per share with an enterprise value of $2.6 billion, making it an attractive target for long-term investors who believe in hydrogen’s future.

Are you looking for the best trading platform? Sign-up to the best trading platform for you for FREE. Takes 2 mins.

Why Did Plug Power’s Stock Collapse?

When Plug Power went public in 1999, it was viewed as a promising player in the green energy sector, focusing on developing hydrogen-powered residential systems. However, this vision didn’t take off due to high hydrogen production costs and the existing efficiency of expanding traditional electrical grids. The company then shifted its focus to hydrogen fuel cells for forklifts and charging stations in warehouses, securing major customers like Amazon and Walmart. These fuel cells helped reduce emissions in fulfillment centers but didn’t immediately lead to financial success.

Plug Power’s financial issues have also been a significant factor in its downfall. Between 2018 and 2020, the company encountered accounting problems, forcing it to restate its earnings. The stock suffered a severe blow in 2020 when Plug Power reported negative revenue after recalculating how stock warrants issued to Amazon and Walmart temporarily eclipsed customer payments. The company’s revenue turned positive again in 2021, but growth has been slow and costs have continued to rise.

While Plug Power deployed over 69,000 fuel cell systems and 250 fueling stations globally, it has had difficulty maintaining consistent revenue and profitability. The company’s acquisitions to expand its cryogenic equipment unit temporarily boosted its growth but masked the underlying weaknesses in its core hydrogen business. These challenges, combined with macro headwinds, have hampered Plug Power’s ability to scale up quickly.

Recent Developments: Institutional Investors Buying In

Despite these challenges, there are reasons for optimism. Over the past 12 months, insiders have purchased seven times as many shares as they’ve sold, signaling confidence in the company’s long-term prospects. Additionally, Norges Bank, Norway’s central bank, has increased its stake in Plug Power to nearly 8%.

In an effort to stabilize its business, Plug Power secured a $1.66 billion loan guarantee from the U.S. Department of Energy to build green hydrogen energy production facilities. This investment will allow the company to ramp up production without immediately going bankrupt, although it would double its debt-to-equity ratio. The Federal Reserve’s recent rate cuts could also provide breathing room for Plug Power as borrowing costs decrease and demand for hydrogen solutions potentially rebounds.

Revenue and Future Growth Projections

Looking ahead, Plug Power is expected to recover, with analysts forecasting revenue to grow 82% to $1.3 billion by 2025 and 41% to $1.8 billion by 2026. Additionally, the company is projected to cut its losses in half by 2026, showing that financial performance could gradually improve. However, these predictions should be viewed cautiously, as Plug Power has historically missed expectations despite making big promises.

Should You Invest in Plug Power Right Now?

Plug Power’s stock has experienced extreme volatility, and while the stock is currently trading at a steep discount, it still faces significant risks. The company is heavily reliant on the broader adoption of hydrogen as a power source, and market dynamics in this sector are still uncertain. If hydrogen technology gains more traction, Plug Power could become a leader in the space, but the company’s current financial instability and ongoing debt issues present a substantial risk to investors.

Analysts are projecting an upside, with price targets set as high as $4. However, the timeline for this recovery remains speculative. For risk-tolerant investors who believe in the long-term potential of hydrogen, Plug Power might be worth considering as a small speculative investment. On the other hand, more conservative investors may want to wait for clearer signs of financial stability or seek safer investments with more immediate returns.

S&P 500 Hits Record High; Dow Gains as Longboard Pharmaceuticals Surges 51% and Tech Stocks Rise S&P 500 Reaches Record

S&P 500, Dow Notch Record Closing Highs as Crude Slumps Major Indexes Set Record Highs: The S&P 500 and Dow

Should You Buy Plug Power Stock While It’s Trading Below $4? A Closer Look at the Hydrogen Pioneer’s Future Plug

MicroStrategy Stock Rises 550% in 2024: Should You Invest? MicroStrategy (NASDAQ: MSTR) has been one of the top-performing stocks in

One of Tesla’s Biggest Bulls ‘Disappointed’ After Robotaxi Event Tesla’s much-anticipated Robotaxi event left one of its most ardent supporters